Table of ContentsHow How Does Facebook Real Estate Help My Business can Save You Time, Stress, and Money.The smart Trick of How To Start A Real Estate Consulting Business That Nobody is Talking AboutSome Of How To Get Into Real Estate Business With No MoneyThe 10-Minute Rule for Which Business Entity May Not Register As A Real Estate Broker

Referrals (previously Field Guides) provide links to articles, eBooks, sites, stats, and more to offer a thorough overview of point of views. EBSCO short articles () are readily available just to NAR members and require the member's nar.realtor login. Realty Brokerage Fundamentals - Property Brokerage Essentials: Navigating Legal Risks and Handling a Successful Brokerage, Fourth Edition is the most comprehensive service tool for brokers to run their offices efficiently and decrease their danger for legal liability. Unlike when buying a piece of domestic home that you will reside in, for which you would run sales comparables on a per-square-foot basis to figure out the worth, you would use a series of other metrics to determine whether a rental residential or commercial property is a good financial investment: What are the anticipated gross annual rents?Will I mortgage the residential or commercial property and if so, what will that payment and other expenses, such as maintenance, vacancy, and energies expense me?What is my net operating income going to be? There are several different types of rental properties you could buy: Every one of these possession classes has various specs and different factors to consider for assessment, however you'll use a few metrics throughout the board for all categories to identify if the residential or commercial property is a sound investment: If you mortgage the residential or commercial property, your bank or personal lending institution may also need to know your numbers for these metrics and how much of a cushion you have in case things do not go as planned (such as if an economic downturn throws your income down).

Get first-hand experience from other landlords and use up a coach who can help you navigate all of the potential benefits and drawbacks. You'll also want to think about gathering as much info as possible in order to handle expectations about what owning property is like by asking professional and expert proprietors to coach you.

You might select to talk to a couple of residential or commercial property supervisors: what is their typical day like? The number of sees will they make to a property in a week? Are they certified in building and construction, property sales, or do they have other customized know-how? Having a residential or commercial property manager you trust can minimize some of the problems that might arise with rental property investing.

Level of financial investment: Medium Personality type: Go-getter with regional knowledge and understanding of building and construction and salesFlipping is another realty investing service, which involves purchasing an underestimated residential or commercial property and improving the value quickly through considerable renovations. Fix-and-flip organisations are hard since you have to understand your market, even at a street-by-street level, incredibly well.

The Main Principles Of What Type Of Business Is An Airbnb Real Estate Business

Generating income this method requires mindful analysis on a micro level. Let's take this example: You buy a property for $200,000 that needs $100,000 worth of work. When the work is finished, you hope the home will be worth $425,000. In addition to the renovation, you have the following costs: Presuming Learn more here everything goes to strategy, after deducting your costs from the selling cost, you 'd have a pre-tax revenue of $83,000.

Managing professionals isn't always easy, specifically if you're new to it. Among the risks, particularly if the building and construction work overruns, is that the selling market could soften between the time you purchase a property and the time you sell it. You likewise need to purchase homes at an extremely low cost in order to earn money, and it may be tough to discover those handle a best-sellers' market.

Standard banks are often weapon shy about financing building jobs, especially since the 2008 economic crisis. Personal loan providers will finance at high loan-to-cost ratios, even as much as 100% of acquisition and 90% of construction costs, but charge high origination costs and interest rates which depend on your experience level and the offer itself.

As you grow, you might establish effective systems and a consistent stream of capital that enables you to flip more than one home at one time. Level of financial investment: MinimalPersonality type: Diligent, resourceful, analytical-- a people personA property agent is typically accredited by the National Association of Realtors and subsequently can call him or herself a Real estate agent (how to start a real estate transaction coordinator business).

See This Report about How To Decide What Business Structure To Use For Real Estate Investing

While the representative's specialized is as a salesperson, they work for a broker whose job it is to supervise them. An agent must work for a certified brokerage, whereas a broker can work individually within his or her own company. A broker is generally more knowledgeable and typically has stronger relationships with individuals in the market such as attorneys, professionals, and title companies.

The commissions are negotiable, however are usually 5% to 6%. The seller pays this commission to his/her representative or broker, who divides it with the purchaser's representative. You can focus on being a purchaser's representative or a seller's agent, or do both. A purchaser's representative has particular responsibilities such as: Helping purchasers find houses that fulfill their criteriaHelping link buyers with funding, title companies, inspectors, and other resourcesHelping purchasers determine risks and issues with houses Working out with sellers to fulfill the purchasers' best interestsSeller's representatives' responsibilities include: Assisting sellers set a listing cost based on sales comparablesAdvising sellers on what they can do to get top dollar for their properties Holding open houses and scheduling showings for prospective buyersNegotiating with buyers and then helping the 2 celebrations get to closing Building a successful property representative organisation is all about networking.

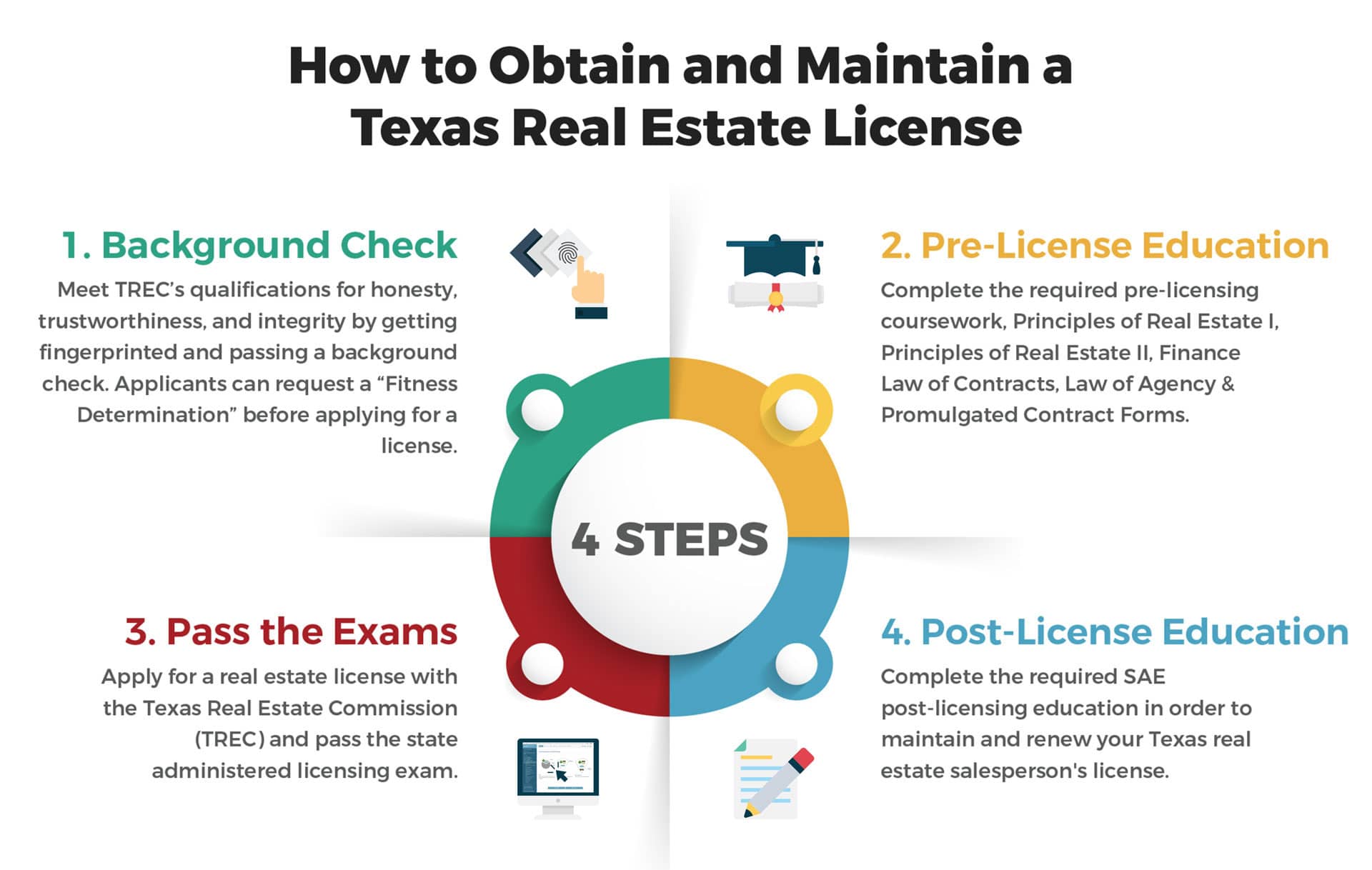

Everybody needs a location to live, and property agents can even make commissions from proprietors for helping them put a certified renter in their properties. This commission is typically about one month's rent, however can be worked out down. Getting a realty representative license varies by state, and typically needs a course, passing a licensing test, and keeping that license up to date with continuing education and the recommendation of or association with a broker/supervisor.

Level of financial investment: MinimalPersonality type: Responsive, versatile, job supervisor who's proficient at issue solvingThere are lots of home owners who have full-time or other jobs, and choose not to carry out the daily duties of landlording. Rather, they hire property managers. Ending up being a home supervisor is one method you can make cash flow from properties without really needing to buy one.

What To Put On The Back Of A Real Estate Business Card Can Be Fun For Everyone

If you charge a 10% management cost, you 'd get $200 to be on call. The more homes you manage, the more effective you can be with responding to work order requests and showings. http://waylonfwqd417.timeforchangecounselling.com/what-does-how-to-become-a-real-estate-agent-in-new-york-mean Numerous home managers likewise charge a cost for positioning a tenant that covers the time and expenditures included in revealing the home, evaluating the tenant, and making sure a smooth move-in.